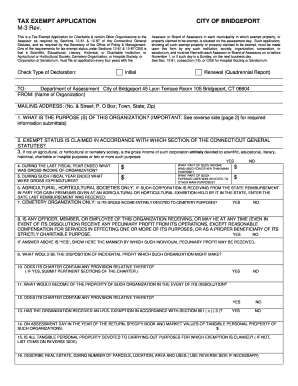

ct sales tax exemption form

For other Connecticut sales tax exemption certificates go here. Sales and use tax exemption for a motor vehicle.

April 2022 Connecticut Sales and Use TaxFree Week - For detailed information on the Sales and Use Tax-Free Week click here.

. This ia a Contractor Sales Tax Certificate which is a special type of certificate intended for use by contractors who are purchasing goods or tools that will be used in a project contracted by a tax-exempt entity like a government agency or tax-exempt nonprofitThe contractor must certify that the goods being purchased tax-free are exclusively for use on the tax-exempt entitys contract. Ad Sales Tax Exempt Exemption Wholesale License Reseller Permit Businesses Registration. Filing Season - DRS asks that you strongly consider filing your Connecticut individual income tax return electronically.

That are not otherwise eligible for a sales tax exemption 50 of the gross receipts from such items 12-412i Sales of goods and services to Connecticut credit unions beginning July 1 2016 12-412 121 MOTOR VEHICLES AIRCRAFT AND BOATS Flyable aircraft 12-412 20 Boats docked in the state for 60 days or fewer 12-408 1 E ii. Gas Tax - For detailed information on the Suspension of the Motor Fuels Tax click here. This will allow you to enter information directly on the form and print the form with the information you entered.

How to use sales tax exemption certificates in Connecticut. Several exemptions are certain types of safety gear some types of groceries certain types of clothing childrens car seats childrens bicycle helmets college textbooks compact fluorescent light bulbs most types of medical. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Connecticut sales tax.

ˇˆ ˆ ˆ ˇ. Ad Download Or Email CT DRS More Fillable Forms Register and Subscribe Now. DRS does not assign tax exempt for meals and lodging.

A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Connecticut sales tax. Sales tax forms and exemption certificates. Sales Tax Exemptions in Connecticut.

You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. Filing Season - DRS asks that you strongly consider filing your Connecticut individual income tax return electronically. In Acrobat Reader select the File menu then select Open then select the form you had just saved.

Connecticut no longer issues exemption permits but accepts for proof of exemption a copy of the Federal Determination Letter or a Connecticut. While the Connecticut sales tax of 635 applies to most transactions there are certain items that may be exempt from taxation. I further certify that if any property so purchased tax free is used or consumed by the firm as to make it subject to a sales or use tax we will pay the tax due direct to the proper taxing authority when state law so provides or inform the seller for added tax billing.

Electronic filing is free simple secure and accessible from the comfort of your own home. Tax Exemption Numbers ere issued only to Connecticut state agencies. Completing Fill-in Forms We are providing a fill-in function for some of our forms.

Launch the Acrobat Reader. Sales use tax resale certificate. April 2022 Connecticut Sales and Use TaxFree Week - For detailed information on the Sales and Use Tax-Free Week click here.

Electronic filing is free simple secure and. For other Connecticut sales tax exemption certificates go here. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Connecticut sales tax.

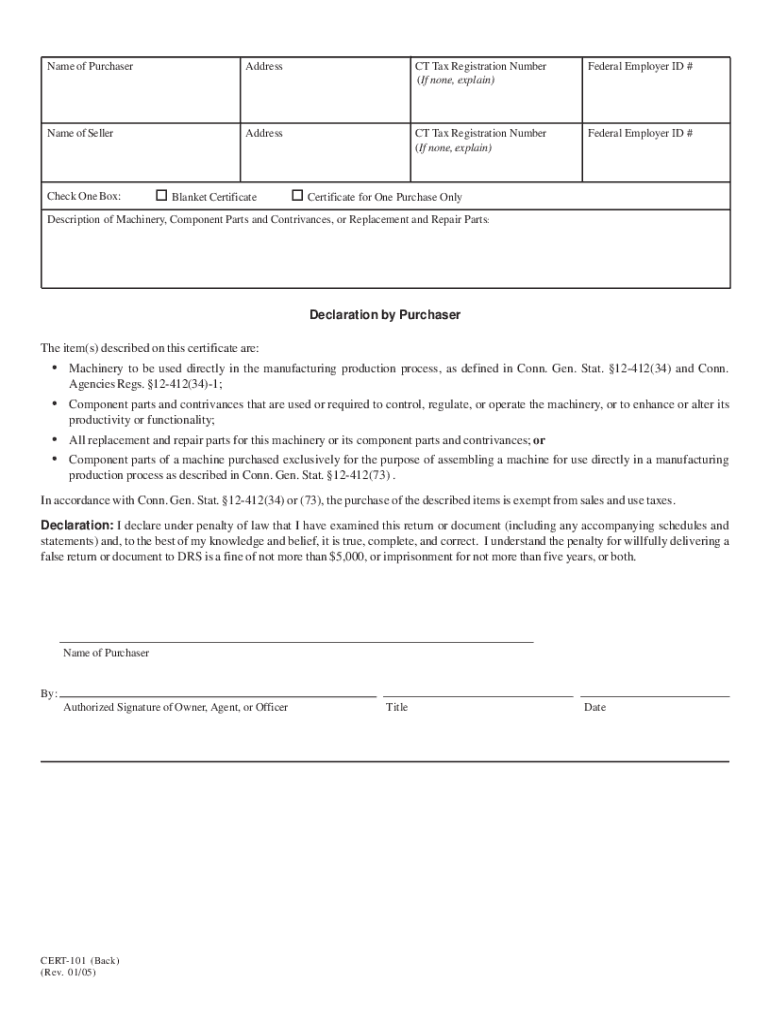

Use your Tax Exemption Numberwhen completing CERT-134 Exempt Purchases numbers to agencies ofthe United States government or to municipalities or their agencies. Ct sales and use tax exempt form. You can download a PDF of the Connecticut Resale Exemption Certificate Form CERT-100 on this page.

Form CT-10 Commonwealth of Virginia Communications Sales and Use Tax Certificate of Exemption For use by a purchaser who purchases communications services for resale an Internet service provider the Commonwealth of Virginia any political subdivision of the Commonwealth and the federal government. March 12 2021 by Leave a Comment. In Connecticut certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

You can download a PDF of the Connecticut General Sales Tax Exemption Certificate Form CERT-100-B on this page. The purchaser must complete CERT-125 Sales and Use Tax Exemption for Motor Vehicle or Vessel Purchased by a Nonresident of Connecticut Conn. Purchases of Tangible Personal Property and Services by Qualifying Exempt Organizations.

Ad Download Or Email Form CT-247 More Fillable Forms Register and Subscribe Now. All it takes is a few clicks to look up your states sales tax rate and important regulations. You can download a PDF of the Connecticut Purchases of Tangible Personal Property and Services by.

This certificate shall be part of. 12-41260 Motor vehicles sold to limited liability companies or their members in connection with the organization or termination of the limited liability company provided the last taxable sale was subject to tax. Printable Connecticut Exempt Purchases by Qualifying Governmental Agencies Form CERT-134 for making sales tax free purchases in Connecticut.

30 rows Alcoholic Beverage Tax Tax Free Sales in Connecticut and Sales to Other Licensed. ˇ ˆˇ. An organization that was issued a federal Determination Letter of exemption under Section 50lc3 or 13 of the Internal Revenue Code is a qualifying organization for the purposes of the exemption from sales and use taxes.

Ct tax registration number if any. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. 2 Form Rev 986 Ct Download Fillable Pdf Or Fill Online Schedule To Support Claim Of Exemption From Corporate Net Income Tax Under P L 86.

Sales Tax Exemption For Building Materials Used In State Construction Projects

Form Reg 8 Fillable Farmer Tax Exemption Permit

Ohio Sales Tax Changes Sales Tax Nexus Tax

Printable Connecticut Sales Tax Exemption Certificates

Form Cert 141 Fillable Contractors Exempt Purchase Certificate

Glass Wood House House In The Woods Canopy Architecture Diy Canopy

How To Get A Resale Certificate In Connecticut Startingyourbusiness Com

Pair Of Marquise Shape Electric Blue Natural Brazilian Paraiba Tourmaline Paraiba Tourmaline Tourmaline Paraiba

Larchmont Manor Sale Town Sea In 2022 Antique Items Larchmont Copper Pots

King Soopers Tax Exempt Form Fill Out And Sign Printable Pdf Template Signnow

Form Ct 206 Fillable Cigarette Tax Exemption Certificate

Cert 101 Fill Online Printable Fillable Blank Pdffiller